Cheap Car Insurance in South Carolina

Everything You Need to Know About Auto Insurance in South Carolina

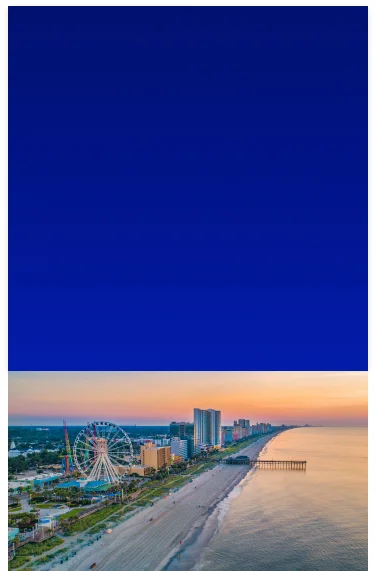

South Carolina, also known as the Palmetto State, is a region renowned for its coastline and historic towns. Here, you can explore picturesque beaches, delve into history at sites like Charleston’s Historic District, and indulge in local cuisine.

Inland, South Carolina boasts natural landscapes, including national parks and forests. Outdoor enthusiasts can enjoy hiking in the Blue Ridge Mountains or take leisurely drives along winding roads surrounded by lush greenery.

To fully embrace all that the Palmetto State has to offer, it is essential to have the right auto insurance coverage. This ensures your safety on the road and meets the state’s legal requirements. Acceptance offers the best car insurance at the lowest price. With the assistance of knowledgeable agents, you can navigate through coverage options to find a policy that suits your needs.

How Much Does Car Insurance in South Carolina Cost?

In South Carolina, car insurance typically costs $524 per year for minimum coverage and $1,532 for full coverage. These rates are actually lower than average car insurance costs in the U.S., which are $622 per year for minimum coverage and $2,014 for full coverage.

However, it’s important to keep in mind that individual car insurance costs can vary significantly. Factors such as your ZIP code, age, driving history, vehicle type, and the specific coverage and limits you choose all play a role in determining your insurance premium. Doesn’t it seem a bit complicated to understand? Luckily, you can choose the best car insurance coverage with the help of friendly Acceptance Insurance agents.

Ready to Get a Quick Quote?

What Is the Average Premium for Cheap Full Coverage Car Insurance in South Carolina?

The average monthly premium for full coverage car insurance in South Carolina is approximately $128. Full coverage insurance offers more than just liability coverage – it provides added benefits to safeguard you in case of an accident, even if you’re at fault.

Here are the three key components of full coverage car insurance:

- Property Damage and Bodily Injury Liability: This component covers the costs of damage you cause to someone else’s car or property or any injuries in an accident where you’re at fault. For instance, if you accidentally rear-end another vehicle, property damage coverage will help cover the costs of repairing the other driver’s vehicle and help pay for any medical-related costs for injuries.

- Comprehensive: This protects you from non-collision-related losses, such as theft, vandalism, and damages caused by natural disasters like hail or fire. For instance, if your car is damaged during a storm or stolen, comprehensive coverage will help cover the repair or replacement costs.

- Collision: If you’re involved in a collision with another vehicle or an object, this coverage will assist in paying for the expenses to repair or replace your car. For example, if you accidentally collide with a tree, collision coverage will help cover the damage to your vehicle.

Having full coverage car insurance that includes these components provides you with comprehensive protection and peace of mind on the road. Remember, it’s important to thoroughly review your options and consult with an agent to ensure you have the best coverage within your budget.

How Much Does Liability Insurance or Minimum Required Auto Coverage Cost in SC?

If you choose the minimum liability insurance required in South Carolina, the average cost is around $44 per month. However, it’s important to remember that opting for minimal coverage means limited protection in case of accidents or damages.

For example, if you’re at fault in an accident, your insurance will only help cover damages and medical expenses for the other party, not your own vehicle. This could result in out-of-pocket expenses for repairs or replacement. Consider your insurance needs and potential financial impact before deciding on coverage.

How do Insurance Rates Compare Across South Carolina’ Major Cities

Where you live can impact your insurance rates, especially in cities like Columbia, Charleston, and Greenville. It’s important to note that insurance premiums in these metropolitan areas might be higher compared to more rural areas. When you’re comparing rates, make sure to take the traffic and accident rates in these cities into consideration. Here are a few cities in South Carolina that you can check out to compare insurance rates:

We use the following methodology to arrive at our average cost: male, age 30, state minimum liability and full coverage of 100/300/100.

What are Some Car Insurance Discounts in South Carolina?

Insurance companies usually offer a variety of discounts, including a good driver discount. This discount could greatly lower your car insurance rate if you have a clean driving record, with no traffic tickets or violations for a specific period of time. So, keep up the good driving to save some cash!

There are some other discounts that you may not be aware of, that can help you reduce your annual premium:

Remember, it’s always a good idea to reach out to your insurance provider and ask about any available discounts. You never know how much you could be saving – and this is just one advantage of working with insurance agents.

Types of Auto Insurance Coverage

South Carolina Car Insurance Laws

South Carolina car insurance laws are in effect for an important purpose. They recognize the reality that not all drivers have the financial resources to handle the expenses of a significant accident on their own. By mandating insurance coverage, these laws ensure that everyone involved in an accident is protected and that the financial burden is shared among insurance companies that have the necessary means to handle such situations. So, it’s not just a formality, it’s about providing security for everyone on the road.

What are Mandatory Vehicle Insurance Requirements in South Carolina?

In the Palmetto State, drivers must have liability insurance coverage to protect against damage they may cause in an accident. The minimum coverage amounts are:

- $25,000 for bodily injuries per person

- $50,000 for bodily injuries per accident

- $25,000 for property damage per accident

Additionally, drivers are required to carry uninsured motorist coverage with minimum amounts of:

- $25,000 per person

- $50,000 per accident

Remember to carry proof of insurance while driving to avoid penalties. Meeting these insurance requirements is important for responsible driving in South Carolina.

What Happens if You are Caught Driving Without Insurance in SC?

You should be aware of the range of penalties you may incur if you are caught driving without insurance in South Carolina. These penalties can apply if you lack insurance altogether or if you fail to carry proof of insurance while driving. Here are the potential consequences:

- Jail time: Depending on previous convictions, a first-time offender could face up to 30 days in jail, while subsequent offenses could lead to a jail term lasting between 45 days and six months.

- Fines: First-time offenders may receive a fine of up to $100, while subsequent offenses can result in fines of $200 or daily fines of $500 for each day without insurance.

- License suspension: Driving without insurance can lead to the suspension of your driver’s license.

What Factors Does South Carolina Law Allow in Determining Your Insurance Premiums?

Determining your insurance premiums in South Carolina can seem overwhelming, but understanding the factors that impact your rates can help.

Your personal information, like your age, gender, and marital status, are some crucial considerations. Insurance companies also pay close attention to your driving record, including any past accidents or moving violations, as well as how often you use your car and how many miles you drive each year.

Your location also matters, with insurers examining the accident rates in your area, as well as crime rates, weather patterns, and traffic congestion.

While many factors come into play, it’s not all doom and gloom! Shopping around and comparing quotes from multiple providers can help you find the most affordable price.

Am I Required to Report an Accident in South Carolina to Authorities?

In South Carolina, you are only required to report a car accident to the authorities if there are injuries or fatalities involved. If the accident only resulted in property damage and no one was hurt, there is no obligation to report it to the authorities.

Find an Office Near You

What is Driving in South Carolina Like?

Navigating South Carolina’s roads can be challenging, especially in cities with high traffic like Charleston, Greenville, and Columbia. Additionally, the state’s varied weather conditions, including heavy rain, thunderstorms, and occasional ice and snow, can make driving more difficult. Stay alert and take necessary precautions, such as checking the weather forecast, to ensure a safe driving experience.

How Many Car Accidents Happen in South Carolina?

Did you know that traffic fatalities in South Carolina continue to increase year after year? In 2021, the Department of Public Safety in the state reported that the number of accidents rose from 1,066 in 2020 to 1,198. Unfortunately, there was also a sad increase in pedestrian fatalities, from 187 to 194, and cyclist fatalities, which increased from 16 to 23.

Additionally, statistics from that year showed that there was one fatal collision every 7.9 hours, one person killed every 7.3 hours, and one person killed in a DUI every 21.9 hours. Remember, it is crucial to buckle up, avoid drunk driving, and stay alert on the road!

How Many Drivers are Uninsured/Underinsured Motorists in SC?

In 2019, South Carolina ranked 28th in the nation for drivers without adequate car insurance coverage, with a whopping 10.9% of drivers lacking proper coverage. This is a concerning statistic because it means many drivers could be left financially unprotected in the event of an unexpected accident. Having comprehensive car insurance is key not only for your own financial protection but also for others who might be involved in an accident. So, let’s make sure we’re all covered and driving safely out there!

FAQs About South Carolina Car Insurance

I am a Low-Income Driver. How Can I Find the Cheapest Car Insurance in South Carolina?

To find the cheapest car insurance in South Carolina as a low-income driver, just contact Acceptance Insurance. We can help you explore minimum liability coverage or affordable full coverage options. Take advantage of our discounts, like safe driver and paperless billing, to get the best price.

Can an Undocumented Worker Get Auto Coverage in SC?

No, undocumented workers cannot obtain auto insurance coverage in South Carolina. State laws prohibit them from obtaining a driver’s license, which is required to access insurance coverage. Currently, South Carolina does not offer any alternative options for undocumented workers to legally obtain insurance coverage.

Is It Possible to Get Auto Insurance in South Carolina with a DUI on my Record?

Having a requirement for DUI insurance on your record in South Carolina may increase the cost of your car insurance, but you can still obtain coverage. State law requires high-risk drivers with a DUI conviction to secure an SR-22 certification, which verifies that you have insurance coverage. It’s important to make all premium payments as failing to do so will result in the state being informed that you are no longer covered.

Find Low-Cost Auto Insurance in South Carolina Today!

Looking for cheap car insurance in South Carolina? Look no further! At Acceptance Insurance, we offer personalized policies that fit your needs and budget. Call 877-405-7102 to speak with our knowledgeable agents, get a quick quote online or visit one of our conveniently located offices.

Get Started